Serving the Dallas Fort Worth Area & Nationwide

Surprising Facts About Identity Theft

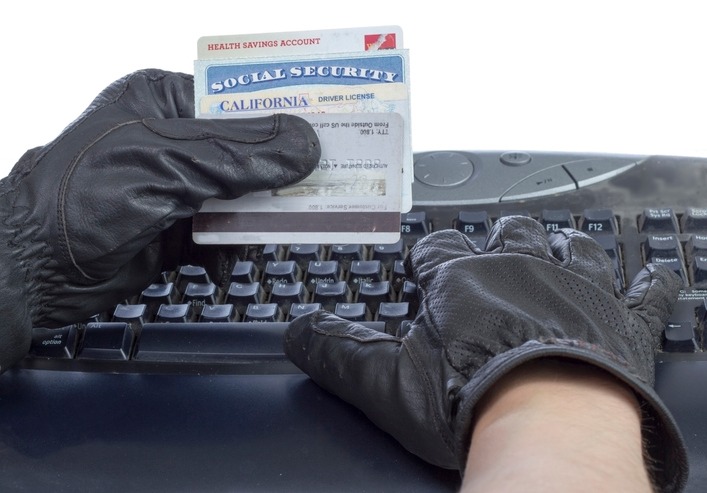

Identity theft is a growing risk in our interconnected world. As technology advances and more personal data is stored and shared online, the risk of falling victim to this crime increases. Identity theft goes far beyond stolen credit card numbers; it’s a sophisticated crime with far-reaching consequences that affect individuals, families, and even businesses. To truly grasp its impact, it’s essential to explore lesser-known and surprising facts about identity theft.

What is Identity Theft?

So, what is identity theft? It’s the fraudulent use of someone’s personal information, like Social Security numbers or financial data.

Surprising Fact #1: Identity Theft Affects People Across All Demographics

One of the most interesting facts about identity theft is its indiscriminate nature. Many people believe that only wealthy individuals or those who are highly active online are targeted, but the reality is far different. Identity thieves do not discriminate based on age, income, or location. Everyone is a potential target.

For example, a report from the Federal Trade Commission showed that a significant percentage of identity theft cases targeted victims under the age of 30, debunking the myth that older individuals are the primary targets. Lower-income individuals are also at risk, particularly because they may lack access to identity theft protection tools or resources.

Geographic location doesn’t provide immunity either. Urban areas may have more reported cases, but rural regions are not exempt. The pervasive nature of identity theft means that anyone with personal information—essentially everyone—is a potential victim.

Surprising Fact #2: The Consequences of Identity Theft Go Beyond Financial Loss

When discussing identity theft, financial loss is often the first consequence that comes to mind. While it is undoubtedly a significant aspect, the emotional and psychological effects can be equally severe. Victims of identity theft often go through stress, anxiety, and a profound sense of violation as their personal information is misused.

Additionally, identity theft can damage a victim’s reputation. In some cases, stolen identities are used to commit crimes or evade responsibilities, leaving the real person entangled in legal complications. Restoring one’s name can take months, sometimes years, of persistent effort, involving piles of paperwork and countless interactions with financial institutions and legal authorities.

The time and energy spent recovering from identity theft is another overlooked consequence. From freezing accounts and disputing fraudulent charges to monitoring for further incidents, the recovery process is exhausting and time-consuming.

Surprising Fact #3: Identity Theft Can Happen Without You Even Knowing It

One of the most unsettling aspects of identity theft is how often it occurs undetected. Many victims of identity theft only discover that their identity has been stolen when the damage is already done. This can include being denied a loan, finding unexplained transactions on a bank statement, or receiving collection notices for debts they didn’t incur.

Data breaches are a significant contributor to this silent form of identity theft. Personal information exposed in breaches can be sold on the dark web and misused without the victim’s knowledge. Phishing schemes and unauthorized credit inquiries are other common methods through which identity thieves operate discreetly.

Early detection is crucial to minimize the damage. Regularly looking over your credit reports and bank statements, setting up fraud alerts, and using identity theft protection services can help you identify unauthorized activities before they escalate.

Surprising Fact #4: Kids and Minors Are Growing Targets for Identity Theft

Identity theft doesn’t only affect adults. Children are increasingly becoming victims, making this one of the most surprising of these 5 facts about identity theft. Minors are attractive targets because they typically have clean credit histories, which are like blank slates for criminals to exploit. In many cases, the theft goes undetected for years because parents don’t think to monitor their child’s credit.

For example, a stolen Social Security number might be used to open fraudulent accounts, take out loans, or even commit tax fraud. Often, the crime isn’t discovered until the child becomes an adult and attempts to apply for a loan or credit card, only to learn their credit is ruined.

There are methods for parents to protect their children from identity theft. Freezing a child’s credit report is one effective method, as it prevents unauthorized access. Additionally, parents should monitor for unusual activity, such as unexpected mail or notices in their child’s name. Educating children about online safety can also reduce their risk of inadvertently exposing personal information.

Surprising Fact #5: Businesses Are Not Immune to Identity Theft—And It Can Cost You Big

Identity theft doesn’t just target individuals. Business identity theft occurs when criminals impersonate a company or its executives to gain access to sensitive data, financial resources, or valuable intellectual property.

The consequences for businesses can be severe. Financial losses from fraudulent transactions, reputational damage from breaches of customer data, and compliance penalties for failing to safeguard information can all result from a single attack. Additionally, the loss of customer trust following a cyberattack can have long-term repercussions.

Cybercriminals frequently target smaller businesses because they may lack robust cybersecurity measures. To mitigate these risks, businesses should invest in cybersecurity tools, train employees to recognize phishing attempts and implement strict protocols for handling sensitive information. Incorporating identity theft protection measures specifically designed for businesses can further strengthen defenses.

Protect Your Business with Secure On-Site Shredding

Protect yourself and your business from the growing threat of identity theft with the trusted services of Secure On-Site Shredding, proudly serving the Dallas-Fort Worth metroplex. As an AAA Certified Member of NAID and experts in secure document destruction, we provide reliable, on-site shredding services to safeguard sensitive information and prevent identity theft. Whether you’re an individual, a family, or a business, we’re here to ensure your peace of mind with environmentally sustainable and HIPAA-compliant solutions. Don’t wait to become a victim—contact us today to schedule a shredding service and take the first step toward secure, worry-free information disposal.